About Us

Image

PURE Specialty Exchange (PSE) is a domestic surplus lines reciprocal insurer dedicated to providing insurance and risk management solutions for PURE members and other responsible high net worth families with higher-risk, complex exposures that fall outside of the admitted market.

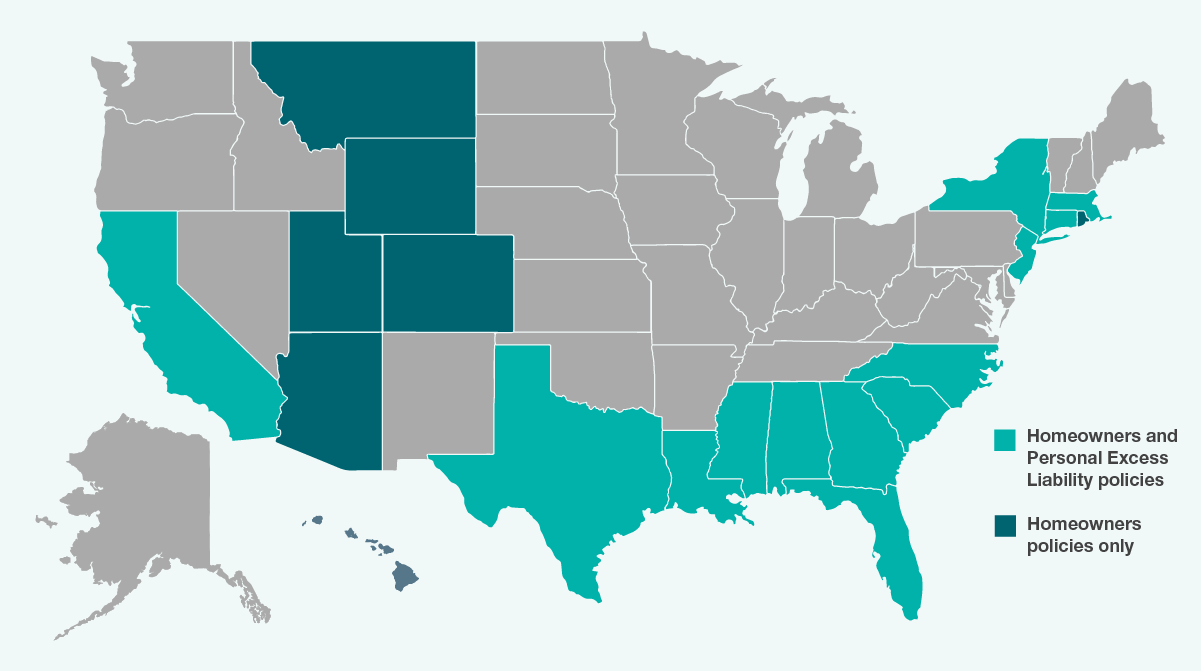

Coverage Availability

| Coverage | State |

|---|---|

| Homeowners and Personal Excess Liability policies | Alabama, California, Connecticut, Florida, Georgia, Louisiana, Massachusetts, Mississippi, New Jersey, New York, North Carolina, South Carolina, Texas |

| Homeowners policies only | Arizona, Colorado, Hawaii, Montana, Rhode Island, Utah, Wyoming |

A Unique Structure

PURE Specialty Exchange (PSE) is a reciprocal exchange, in which:

- PSE policyholders are members who agree to pool risk through the exchange of insurance contracts.

- Members pay a surplus contribution equal to 10% of their premium for the first five (5) policy terms of each PSE policy. Surplus contributions help strengthen PSE’s balance sheet and reduce the cost of insurance over time.

- Members appoint an Attorney-in-Fact to manage day-to-day insurance operations. PSE’s Attorney-in-Fact is PURE Specialty Risk Management, LLC.

- PSE’s underwriting profits or other surplus gains may be allocated to Member Savings Accounts held in the name of each member with an active participating policy.

- PSE members will access the same claims, risk management, Member Advocate and service resources as are available to PURE.

For additional details, please review PSE’s Membership Agreement.

Financial Strength

PURE Specialty Exchange is rated A (Excellent) for Financial Strength by AM Best. Visit ambest.com to view the full rating.